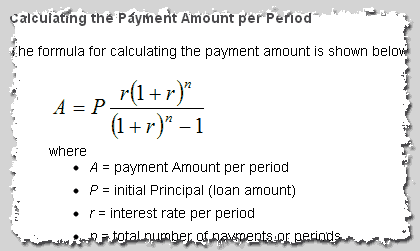

Debt payment formula

Monthly rent or house payment. It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders.

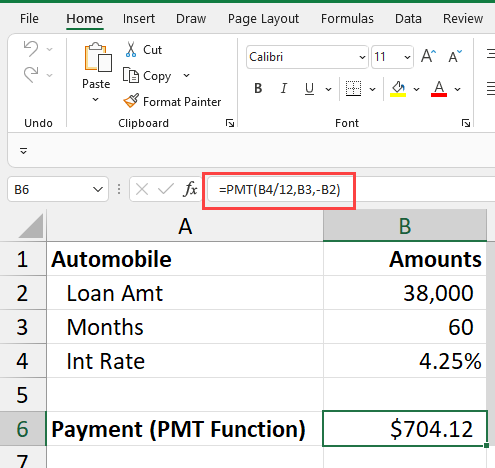

Pmt Function In Excel How To Use It To Calculate Loan Payment Chris Menard Training

As already explained in the example above the calculation of the net debt ratio is pretty simple.

. The formula is Total Debt Total Capital. Debt service coverage ratio as its name suggests is the amount of cash a company has to servicepay its current debt obligations interest on a debt principal payment lease payment etc. Debt to Equity Ratio in Practice.

SBAs table of small business size standards helps small businesses assess their business size. If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is 042. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

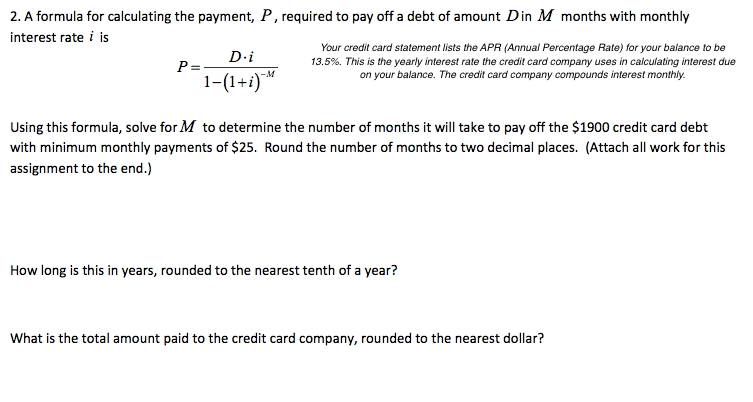

Be sure to label the additional payment apply to principal Simply rounding up each payment can go a long way in paying off your mortgage. Credit card monthly payments use the. Payment history is the record of whenand ifyou pay your bills.

The debt ratio can be expressed as either decimal or percentage. These values can be easily found on the balance sheet. Student auto and other monthly loan payments.

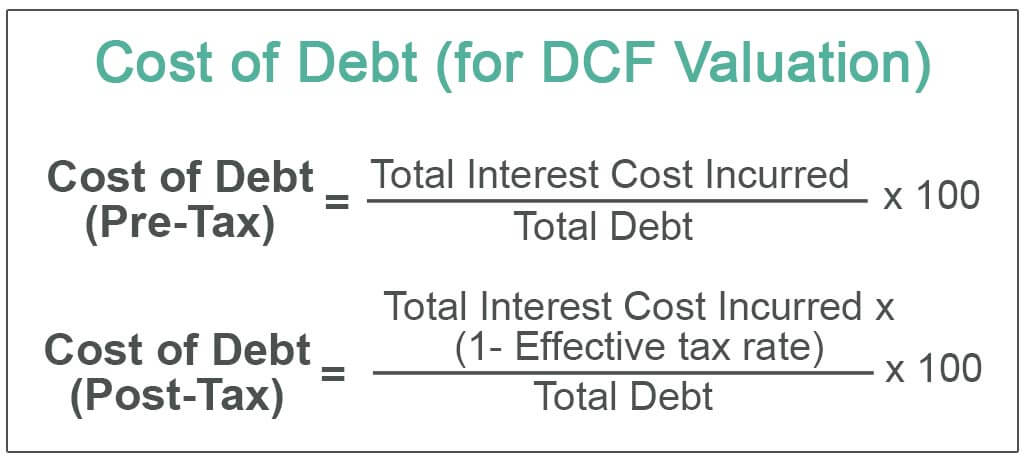

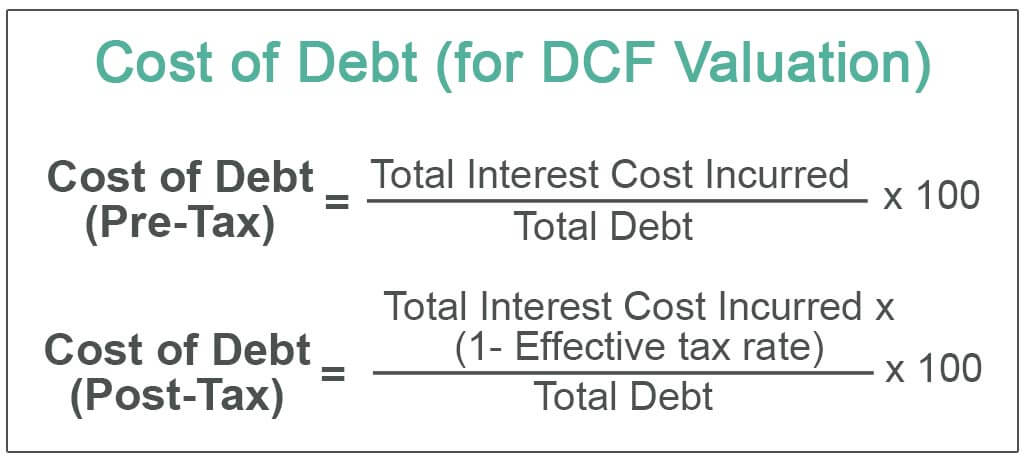

Cost of Debt Pre-tax Formula Total Interest Cost Incurred Total Debt 100. Good 690-719 After plugging in these numbers HomeLight estimates that you can afford a home that costs 282997 with monthly payments of 2100. Total Tangible Assets Value.

Debt Service Coverage Ratio Formula. For example instead of 763 pay 800. And its one of the main things that creditors look at.

Add up your monthly bills which may include. Lets break down how everything factors in. The main issue arises in locating the figures from the financial statementsIt is easy to remember that the short-term debt will always be listed under the current liabilities liabilities or debts due in a year and the long-term debt would be listed under the.

1 or higher the ratio value says a company has good earnings to remunerate its entire debt obligations. It means on average the company takes 60 days to pay its creditors. This means that for every dollar.

Child support or child maintenance is an ongoing periodic payment made by a parent for the financial benefit of a child or parent caregiver guardian following the end of a marriage or other similar relationshipChild maintenance is paid directly or indirectly by an obligor to an obligee for the care and support of children of a relationship that has been terminated or in some cases. The average payment period of Metro trading company is 60 days. The values are applied in the below formula to get the Debt Service coverage ratios calculated.

A shorter payment period indicates prompt payments to creditors. In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial. In contrast the payment of dividends to equity holders is not mandatory.

The formula to figure this is 200000 205000 2 so the average accounts payable is 202500. We bring you the best coverage of local stories and events from the Dumfries Galloway Standard and Galloway News. To calculate your debt-to-income ratio.

The debt ratio can be computed using this formula. The management team will use this information to determine if paying off credit balances faster and receiving discounts might produce better results for the company. It is made only upon the decision of the companys board.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report. These companies have a higher chance of continuing to meet their payment duty on time.

The higher the debt ratio the. 399 Homeowners association. An availability based hospital the debt service will comprise a large portion of CFADS during the debt tenor eg.

A common strategy is to divide your monthly payment by 12 and make a separate principal-only payment at the end of every month. In an efficient market higher levels of credit risk will be associated with higher borrowing costs. Debt Service Coverage Ratio DSCR Net Operating Income Total Debt Service.

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. It is better not to loan Loan A loan is a vehicle for credit in which a lender will give a sum of money to a borrower or borrowing entity in exchange for future repayment. Like accounts payable turnover ratio average payment period also indicates the creditworthiness of the company.

If the company fails to meet its Interest Payment continuously Lenders would worry about their capital. Read more the amount to that. To determine the debt ratio we will need to know the total liabilities debt and total assets.

Monthly alimony or child support payments. If the proportion between the net operating income and the debt payment is too low like one or less it is better not to go for debt financing. So the average payment period the company has been operating on is 84 days.

Debt to Equity Ratio short term debt long term debt fixed payment obligations Shareholders Equity. It is calculated by dividing the companys net operating income by its debt obligations for that particular year. Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score.

All the latest news views sport and pictures from Dumfries and Galloway. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. Non-payment of debt obligations would adversely affect the overall creditworthiness Creditworthiness Creditworthiness is a measure of judging the loan repayment history of borrowers to.

With 115x DSCR while in riskier endeavors like in mining the DSCR will be much greater eg. Debt to equity ratio also termed as debt equity ratio is a long term solvency ratio that indicates the soundness of long-term financial policies of a company. In projects with no demand risk eg.

As the debt to equity ratio expresses the relationship between external equity. 200x and the debt service will be a much lower proportion of CFADS. Payment history makes up 35 of your credit scorethe biggest part.

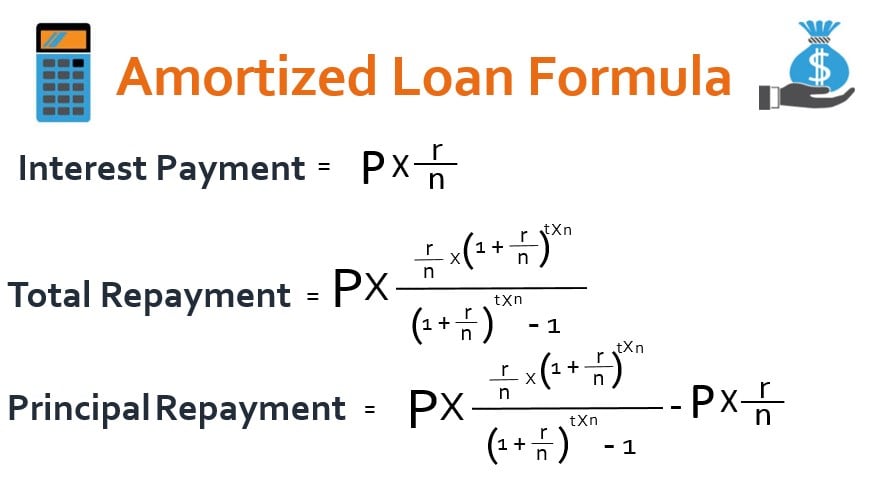

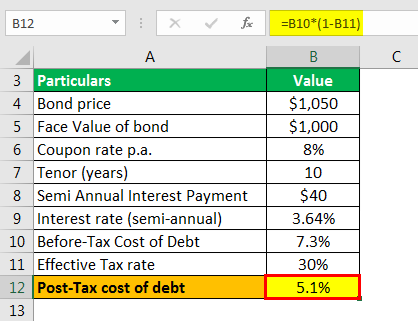

The debt ratio is another measure of leverage. Debt to Capital Ratio is a Solvency ratio that indicates how much of the companys capital is funded via Debt. The formula for determining the Post-tax cost of debt is as follows.

The formula is Total Debt Total Capital. Debt Ratio Formula. Length of Credit History.

Hence leveraged companies are more risky. They may even ask for the repayment of. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

For FICO Scores calculated from older versions of the scoring formula this shopping period is any 14-day span.

Annual Loan Payment Calculator Deals 53 Off Www Ingeniovirtual Com

Time To Pay Formula Youtube

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

How To Calculate Debt Service Coverage Ratio Dscr In Excel

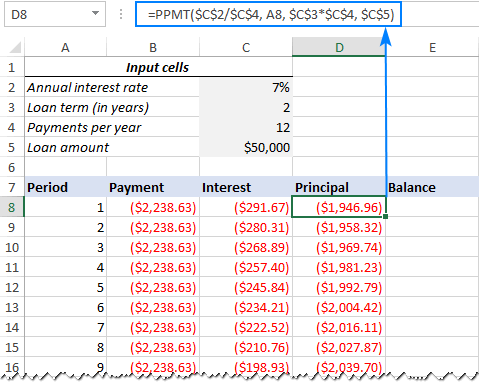

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

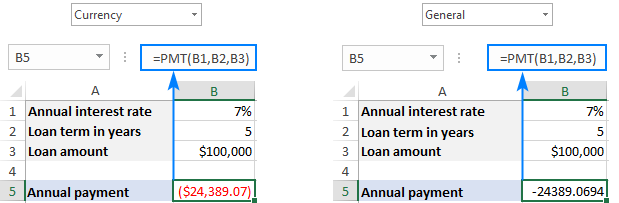

How To Use The Excel Pmt Function Exceljet

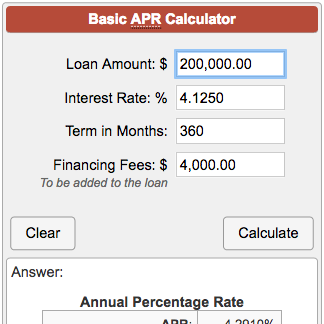

Basic Apr Calculator

Simple Loan Calculator

Loan Payment Formula With Calculator

Excel Pmt Function With Formula Examples

Excel Formula Calculate Payment For A Loan Exceljet

Loan Payment Calculator With Interest Top Sellers 58 Off Www Ingeniovirtual Com

Excel Pmt Function With Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Solved 2 A Formula For Calculating The Payment P Required Chegg Com

How To Calculate A Debt Constant Double Entry Bookkeeping

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc